Risk & Exposure: When Marketing, Compliance, and Cyber Insurance Collide

Your marketing stack might be killing your cyber coverage.

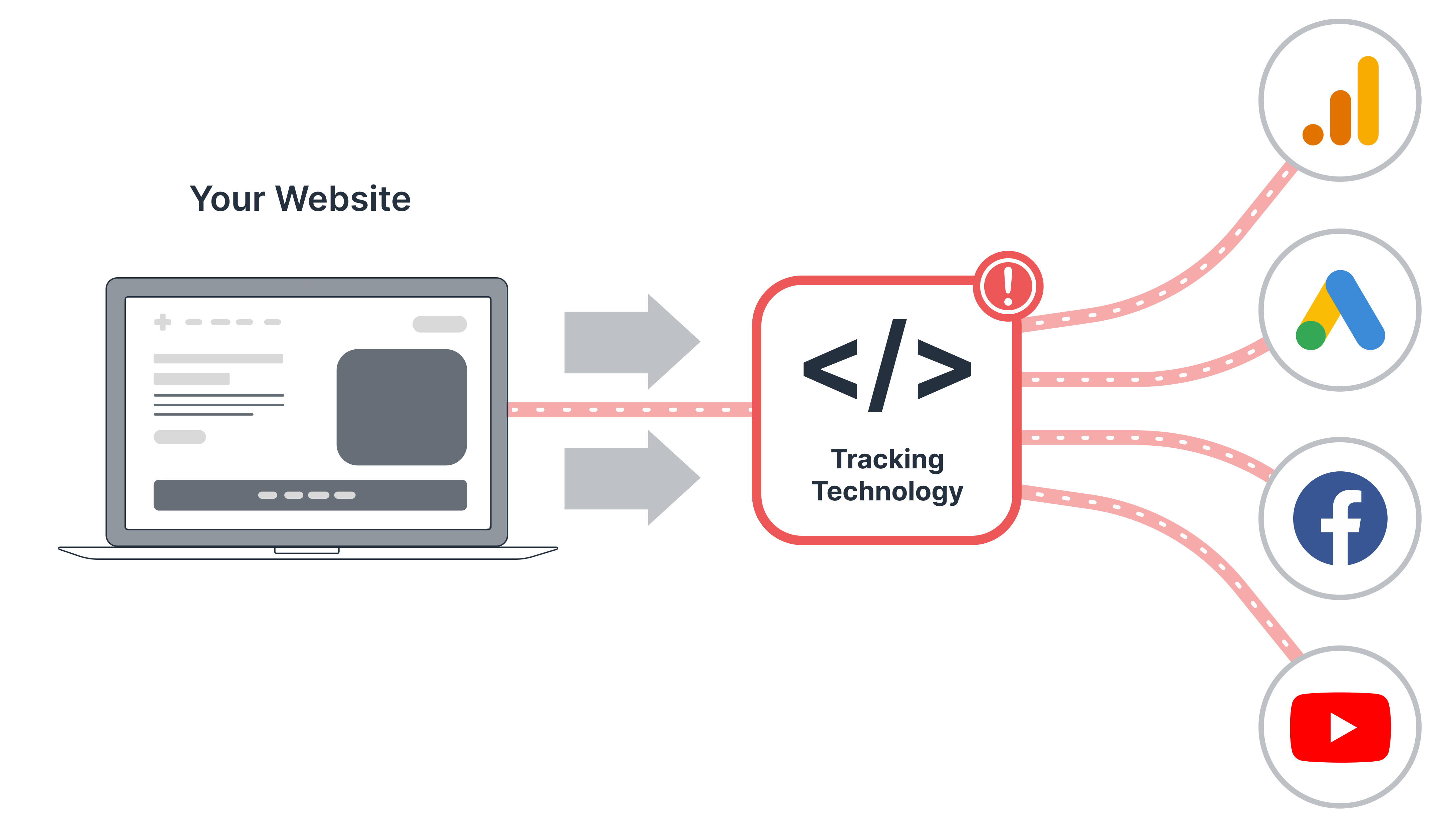

Today’s marketing and analytics tools—pixels, scripts, tracking tech—are no longer just a privacy concern. They're an insurability risk. From HIPAA enforcement to stricter cyber underwriting, digital operations are under the microscope.

Risk & Exposure is a webinar series for legal, compliance, finance, and risk leaders working in healthcare. We’ll be joined by industry experts to dig into how digital strategies drive liability, impact coverage, and how to defend against both legal and financial fallout.

Register for the Full Series

Or pick and choose from the individual episodes listed below.

Part 1 | When Marketing Increases Liability: How Marketing Practices Impact Cyber Insurance Coverage

Available On-Demand

In this first session, we’ll break down how insurers are assessing marketing tech stacks—and how tactics you’ve used for years may now be driving up premiums, increasing claims denial risk, or triggering policy exclusions. Learn from legal and cyber insurance experts on what’s changed, what to watch for, and how to take back control.

Part 2 | Getting Audit-Ready: How Internal Teams Can Prove Privacy Defensibility to Insurers

Insurers and auditors are raising the bar—and asking for proof. In Part 2 of the Risk & Exposure Series, we’ll explore how internal teams can prepare for scrutiny with aligned documentation, policies, and technical controls before a breach or claim denial occurs.

Part 3 | When Privacy Risk Becomes Financial Exposure

HIPAA and state privacy laws are clashing with marketing technologies—and creating complex risk profiles for insurers to untangle. In Part 3, we’ll explore how insurance carriers, brokers, and underwriters can assess digital exposure, spot red flags in client tech stacks, and recommend remediation paths that improve insurability.